Kuwait and the United States: A Strategic Relationship from Oil to Investment and Sustainable Development

Over seven decades, Kuwait and the United States have built a deep strategic relationship transcending traditional producer-consumer partnership, evolving into a multidimensional model encompassing security, economics, investment, and cooperation in sustainable development and technological innovation. In a world witnessing rapid geopolitical and economic transformations, this relationship stands at a critical juncture: How can it evolve to meet twenty-firstcentury demands? From Energy to Comprehensive Partnership Since Kuwait began exporting oil in 1946, a special relationship formed based on energy and mutual dependence: the United States needed stable supplies to fuel its expanding post-war economy, while Kuwait found a strategic partner for building a modern oil sector and developing infrastructure. As Kuwait’s OPEC membership solidified and its role in production and pricing policies grew, it transformed from a supplier dependent on foreign concessions to an influential global energy actor. The 1970s shocks redrew the relationship. The 1973 embargo following the October War, then the 1979 Iranian Revolution crisis, pushed the United States toward new energy policy based on diversification, efficiency, and alternatives. With breakthroughs in horizontal drilling and hydraulic fracturing, shale production rose in subsequent decades, reducing direct Middle East dependence, though the Gulf remained fundamental to global market stability. 1991: A Strategic Turning Point 1991 marked a decisive turning point when the United States led the international coalition liberating Kuwait from Iraqi invasion. This was not merely military but an affirmation of American commitment to Gulf Arab security and stability, laying solid foundation for long-term strategic partnership extending to today. Since then, security and defense cooperation has deepened. Kuwait hosts important American military bases and is a key partner in regional counter-terrorism efforts and ensuring navigation freedom in vital maritime corridors. Sovereign Wealth: From Surpluses to Investment Partnership Gulf countries—led by Kuwait—channeled oil surpluses into long-term international assets. Kuwait pioneered this path in 1953 through a sovereign arm accumulating extensive expertise. Despite losses during Iraqi invasion, portfolios were rebuilt through prudent management until becoming among the world’s largest. The Kuwait Investment Authority, managing one of the world’s largest sovereign funds (approximately one trillion dollars), maintains massive American investments estimated at hundreds of billions, distributed across technology, real estate, infrastructure, and financial services. These investments reflect Kuwait’s confidence in the American economy and represent strategy for income diversification and long-term returns for future generations. Conversely, Kuwait witnesses increasing American investment flows, particularly in technology, financial services, healthcare, and consulting. The equation shifted from “oil for goods and technology” to broader network encompassing investment, asset governance, and market integration, while supply security and price stability remain core shared interests. Investment and Institutional Partnership: Toward a Shared Future Today, investment and institutional partnership has moved to the relationship’s forefront, with increasing focus on financial, technical, and regulatory channels supporting economic diversification, maximizing capital returns, and establishing compliance with international standards. In this context comes the initiative to hold “Kuwait—Beacon of a New Era” on October 14 at George Washington University, with high-level Kuwaiti and American financial, economic, and political participation, jointly organized by the Kuwait Banking Association and N-Square Capital, partnering with the U.S. Chamber of Commerce (strategic partner) and Bentley University (academic partner). The session addresses specific themes convertible into joint programs: • Financial Infrastructure as Platform: Banking sector resilience (cybersecurity/business continuity plans), cross-border and instant payments, and next-generation Islamic finance (embedded products, tokenized sukuk, digital customer onboarding). • Capital Efficiency and Global Integration: Joint investment mandates, auditable ESG standards, and practical regulatory reforms to reduce capital costs and expand fintech scope. • Private Sector Leadership and Strategic Growth: Family offices as long-term capital sources, blended finance to reduce pioneering project risks, and publicprivate partnership plans through transparent channels and performance-based contracts. This approach shifts the relationship from oil import dependence to deeper exchange in investment, knowledge, and regulation: the United States as institutional financial and technical partner, Kuwait as long-term investor and emerging regional hub in Islamic finance, financial infrastructure, and fintech. These three themes provide practical pathways maximizing mutual benefit: strengthening banking resilience, improving capital efficiency and standards alignment, and empowering the private sector through innovative financing and sustainable partnerships. A Renewed Partnership for a New Era The Kuwait-U.S. relationship embodies how strategic partnerships evolve with changing times. From oil to investment, security to sustainable development, this relationship has adapted and renewed while maintaining its foundation of shared interests and mutual respect. The future holds greater potential. In a world transforming toward green economy, digital economy, and technological innovation, Kuwait and the United States possess all ingredients for twenty-first-century partnership—extending beyond goods and services to knowledge, technology, and shared values building a more sustainable and prosperous future for coming generations. Ultimately, this relationship’s strength is measured not only by trade volumes or investments but by creating real mutual growth opportunities and contributing to regional stability and prosperity. This is the solid foundation for enduring strategic partnership serving both peoples and the entire region.

H.E the Governor of the CBK Kuwait banking system is strong and well-capitalized, with liquidity and governance to support growth

In an insightful interview, H.E. Basel Ahmad Al-Haroon, Governor of the Central Bank of Kuwait (CBK), shares Kuwait’s approach to navigating a dynamic global landscape—covering global trends, monetary policy, financial stability, sustainable finance, and digital transformation. He highlights a strong, well-regulated banking sector with solid indicators, positioned to finance national development priorities, and notes Kuwait’s resilience amid uncertainty. The discussion sets out CBK’s prudent, balanced monetary stance—using tools such as the discount rate to preserve the dinar’s competitiveness while supporting sustainable growth.

On sustainability, CBK’s agenda aligns with New Kuwait 2035, integrating ESG and climate action. On innovation, initiatives including the Wolooj Innovation Hub and the recent AI conference reflect a forward-looking strategy to adopt emerging technologies with security and stability at the core. Collectively, the Governor’s responses reaffirm Kuwait’s proactive posture: fostering collaboration and building a resilient, innovative, and sustainable financial ecosystem.

Global and Regional Economic Outlook

How do you view current developments in the global economy, and what does it mean for Kuwait’s economy? The global economy continues to operate under a climate of elevated uncertainty. Trade and rising geopolitical fragmentation have weighed on growth prospects and increased volatility in markets. Regionally, expectations for 2025–2026 point to a gradual recovery, underpinned by the normalization of oil production, and progress on structural reforms. The GCC economies, in particular, are strengthening their performance by expanding non-oil sectors and pursuing diversification strategies, supported by strong public investment and reform momentum. For Kuwait, the outlook is broadly balanced and tilted toward the positive. After a period of belowtrend growth linked to OPEC+ production cuts, our economy is projected to expand by 2.6% in 2025. Non-oil activity will also remain resilient, supported by structural reforms, and strong private demand. Of course, global risks remain, such as weaker trade, fluctuating oil prices, and uncertain monetary policy paths in advanced economies. However, Kuwait is well-positioned to weather these uncertainties, as it is supported by solid macroeconomic fundamentals, large fiscal buffers, a resilient banking sector, and a robust regulatory framework. Monetary Policy & Financial Stability • Given the latest global developments and heightened uncertainty, how does the Central Bank of Kuwait adjust its monetary policy tools in response to international interest rate trends and regional economic dynamics while safeguarding domestic stability? In navigating this complex environment, the Central Bank of Kuwait has reaffirmed its role as a cornerstone of stability. CBK has pursued a balanced and prudent monetary policy, guided by continuous monitoring of global and domestic indicators. Unlike many of its regional peers, and thanks to its peg to an undisclosed basket of currencies, the CBK did not replicate the accelerated pace of interest rate hikes witnessed in other countries. Instead, it opted for a gradual, well-calibrated approach designed to preserve monetary and financial stability, safeguard the competitiveness of the Kuwaiti dinar as a reliable store of domestic savings, and support conditions conducive to sustainable growth.

To achieve its objectives, the Central Bank of Kuwait relies on multiple monetary policy tools— including the discount rate, liquidity requirements, and open market operations. Among these, the discount rate remains the primary instrument, shaping lending and deposit rates and supporting the competitiveness of the Kuwaiti dinar as a preferred means of domestic savings. It is worth highlighting that the Central Bank of Kuwait has received considerable recognition during the period of restrictive monetary policy. The IMF commended Kuwait’s exchange rate regime, noting that the current system which pegs the KD to an undisclosed basket of currencies continues to provide an appropriate framework for monetary policy.

• Despite global challenges, Kuwait’s banks are consistently ranked among the strongest in the region. What are your priorities for maintaining this resilience and safeguarding the sector against potential financial shocks, and what is your outlook for the sector?

The Central Bank of Kuwait has strengthened its supervisory and macroprudential oversight. Its framework is anchored in a forward-looking process that integrates continuous monitoring of global and domestic developments with careful assessment of their potential transmission to the Kuwaiti financial system. This is complemented by in-depth analysis of sectoral strengths and vulnerabilities, which provides the basis for activating macro prudential instruments when required. By embedding these elements into a cohesive cycle, CBK ensures that emerging risks are addressed proactively, while at the same time preserving the conditions necessary for sustainable and balanced financial intermediation.

The Central Bank of Kuwait has strengthened its supervisory and macroprudential oversight. Its framework is anchored in a forward-looking process that integrates continuous monitoring of global and domestic developments with careful assessment of their potential transmission to the Kuwaiti financial system. This is complemented by in-depth analysis of sectoral strengths and vulnerabilities, which provides the basis for activating macro prudential instruments when required. By embedding these elements into a cohesive cycle, CBK ensures that emerging risks are addressed proactively, while at the same time preserving the conditions necessary for sustainable and balanced financial intermediation.

With that said, the Kuwaiti banking sector has continued to deliver strong results, underscoring its pivotal role in the economy. By mid-2025, total assets stood at KWD 97.3 billion, up from KWD 91.7 billion at the end of 2024—an annual increase of 6.1%. Credit to the private sector (resident & nonresident) reached KWD 59.8 billion in Q2 2025, reflecting a year-onyear rise of 7.2% (compared to Q2 2024). Household and real estate lending continue to account for a little over half of credit portfolios, consistent with historical patterns. The financial soundness indicators further confirm the sector’s resilience:

• Capital Adequacy Ratio: 18.3% (well above the 13% regulatory minimum).

• Non-performing loan ratio: 1.6%, supported by high provisioning coverage at 242%.

• Net Stable Funding Ratio (NSFR): 113.3%, comfortably above requirements. Beyond its current performance, the banking sector is expected to play an expanding role in financing Kuwait’s development priorities. With strong capital buffers and a stable operating environment, banks are well positioned to support major projects in infrastructure, housing, and energy. Such financing will be structured through diversified instruments and prudent risk management, ensuring alignment with stability objectives while advancing longterm economic growth. Sustainability & Green Finance

• ESG and climate finance are becoming priorities for central banks worldwide. How is the CBK encouraging sustainable finance in Kuwait?

In line with the growing global interest in sustainable finance, and in fulfillment of the vision of His Highness the Amir Sheikh Meshaal Al-Ahmad Al-Jaber Al- Sabah, which focuses on achieving sustainable development, as well as the goals of “New Kuwait 2035” vision, CBK has been proactive in promoting sustainable development and implementing sustainable finance in the banking sector. On November 17, 2022, CBK issued a circular to local banks outlining guidelines for sustainable finance, covering three sustainability factors: environmental, social, and governance (ESG). Key elements include: encouraging banks to develop products that comply with green finance principles; implementing sustainability principles across all bank operations; publishing annual sustainability reports; and integrating ESG into their risk management, capital allocation, as well as their lending and investment decisions. CBK has also emphasized that climaterelated financial risks fall within the environmental dimension ESG standards, requiring banks to refer to the Principles for Effective Management and Oversight of Climate-Related Financial Risks which was issued by the Basel Committee in June 2022. When it comes to climate-related risks, Kuwait plays an evolving yet crucial role, especially considering its position as a major oil producer. Kuwait has shown consistent commitment to the global climate agenda, having ratified the United Nations Framework Convention on Climate Change in 1995, the Kyoto Protocol in 2005, and the Paris Agreement in 2015. Kuwait actively participates in international climate summits, regularly reaffirms its commitment to international climate resolutions, and has pledged to achieve carbon neutrality by 2060. Kuwait’s national development plan, “New Kuwait 2035” vision, places climate action at the center of its strategic direction. The government is also fostering regional and international partnerships, and has launched multiple national initiatives that integrate climate considerations into economic and policy planning, including promoting green investment across various sectors, with a growing role for the private sector in supporting and implementing these initiatives.

Digital Transformation & Innovation

• Several fintech providers have recently been licensed in Kuwait. How do you see them reshaping the country’s financial ecosystem?

Fintech is reshaping financial systems worldwide, and Kuwait is no exception. The licensing of several fintech providers marks an important step in modernizing our financial ecosystem, bringing in more efficient and cost-effective services. While some view fintech as a competitive challenge to traditional banks, we see it as an opportunity to build a more diverse, resilient, and forward-looking sector. The future will not only be competitive, but also collaborative, with traditional institutions and fintech companies working together to combine their strengths. This collaboration will help create a more innovative, sustainable, and digitally driven financial system that meets the needs of Kuwait’s dynamic economy, while also fostering financial inclusion.

• With rapid advances in digital finance and emerging technologies, how is the Central Bank of Kuwait fostering an environment that balances innovation with security andstability?

Innovation in the financial sector cannot be left to chance; it needs a trusted and well-supervised environment. At CBK, we launched the “Wolooj” Innovation Hub in 2023 in line with our vision to promote innovation. Wolooj, which means “access” in Arabic, plays a key role in driving the innovation cycle, transforming ideas into tangible solutions through resource sharing, experimentation, and cross-disciplinary collaboration. It provides a controlled environment to test new technologies and develop advanced solutions in different financial areas. This reflects our commitment to building local capability and preparing Kuwait’s financial ecosystem for the future through encouraging innovation while ensuring that financial stability and systemic security remain intact.

• Would you highlight one of the early achievements from this innovation environment, and how it strengthens Kuwait’s financial sector?

One of the first outcomes is a pioneering technology for generating cryptographic keys, developed under Wolooj. This achievement is significant because it enhances the security backbone of Kuwait’s financial system, supports secure digital transactions, and reduces reliance on external providers for critical infrastructure. It is not just about safeguarding today’s systems, it lays the foundation for future innovations such as instant payments, open banking, and advanced digital services, while also strengthening Kuwait’s digital sovereignty. Another significant achievement worth highlighting is the Initiative Accelerator Program managed by Wolooj, which is a dynamic initiative aimed at supporting aspiring Kuwaiti individuals with innovative ideas that benefit the banking and financial sector in Kuwait. The program is designed to foster creativity, innovation and entrepreneurship within the local ecosystem by providing willing participants with the necessary support, resources and mentorship needed to turn their ideas into successful ventures.

• CBK recently hosted an Artificial Intelligence (AI) conference entitled “Central Banks in the Age of Artificial Intelligence.” Why was this theme chosen?

The title reflects the landscape that central banks are operating in where uncertainty is a defining characteristic in the banking sector, and shocks have been increasingly interconnected. This growing interconnectedness has shortened the time between the start of economic disruptions and their impact on monetary policy decisions, creating an increasing demand for analytical agility and readiness to respond in the face of evolving developments. Against this backdrop of reality, Artificial Intelligence stands out as both a transformative opportunity and a source of risk. The theme was chosen to highlight this dual challenge: central banks must safeguard stability, while also harnessing the adoption of AI to strengthen analysis, supervision, and sound decision-making. The conference included participation from local and regional banks, as well as from international institutions, where we were able to discuss issues that have an effect on all of us.

• Could you walk us through the two sessions of the conference and explain why and how they were connected?

The conference had two panel discussion sessions which were designed to build upon each other. The first session set the stage by outlining the challenges and pitfalls, while the second session questioned whether AI can be part of the solution and how. The first session was titled “Shaping Resilient Systems in a Fragmented World”, and it provided the broad context of the topic at hand through highlighting that we live in an era of continuous uncertainty and fragmentation, and where resilience is not optional but rather essential. This session also emphasized in detail about the global shifts that are reshaping financial systems, such as: rising public debt, uneven global growth, heightened geopolitical tensions, trade fragmentation, and the rapid advances of technology such as crypto assets and artificial intelligence. While central banks in the GCC have strong fiscal positions and resilient banking sectors, they remain exposed to oil price swings, dollar shifts, and global financial risks, and so delaying reforms only raises costs and undermines confidence. The second session titled “AI Adoption in Central Banks – Practical Uses and Governance”, explored how artificial intelligence may support central banks in this environment by processing vast data, modelling complex dynamics, and improving forecasting. The session also tackled the need for proper governance, and management of concentration and cyber risks. While AI offers real benefits in supervision, stress testing, and forecasting, it also introduces systemic risks such as herding behavior, concentration of services among a few providers, exposure to misinformation, and an increase to cyberattack exposure. It remains clear that AI must be guided by robust governance frameworks, investment in skills, and a flexible but disciplined regulatory approach.

• The conference brought together leading experts and regulators. How did their perspectives shape the discussions?

We deliberately sought a mix of voices from policy leaders, technology experts to practitioners. Some of the distinguished panelists include a former Governor of a prominent European central bank, a Vice Governor and Professor from the region, as well as executives from the Financial Stability Board (FSB), the International Monetary Fund (IMF) and the Bank for International Settlements (BIS). Regulators and central bankers stressed the urgency of timely Basel III implementation, stronger buffers, and clear communication to maintain credibility. Technology experts showed both the potential and the limits of AI with the risks associated with adoption, emphasizing that it should enhance, not replace, human judgment. Regional perspectives added important nuance, noting strong fundamentals but also vulnerabilities tied to oil prices and global financial conditions. This diversity ensured that discussions were not just theoretical, but practical and rooted in real-world experience.

• Looking ahead, what message should participants take from this conference?

In today’s world of economic pressures, geopolitical fragmentation, and rapid technological disruption, central banks cannot afford to be complacent. The question should not be whether to engage with AI, but how to do so responsibly by incorporating these novel risks into existing frameworks. Resilience in this environment depends on proactive surveillance, transparent communication, and strong regional and international cooperation. No central bank can address these issues alone, and only by working together, learning from one another, and adhering to international standards can we ensure that AI strengthens, rather than undermines, financial stability.

Ambassador of Kuwait to the USA Sheikha Al-Zain Al-Sabah: The next decade is about reintroducing Kuwait to the world

• How do you see the evolution of Kuwait–U.S. relations in today’s changing global climate?

The Kuwait-U.S. relationship is one of the most enduring and resilient partnerships in the region. It is rooted in shared sacrifices, particularly during the liberation of Kuwait, and it has evolved into a multifaceted alliance. In today’s rapidly

shifting global climate, marked by economic uncertainties, energy transitions, and geopolitical realignments, this partnership is moving beyond defense and security into areas such as education, renewable energy, digital transformation, and healthcare. What excites me most is that it is becoming a people-to- people partnership, where our students, entrepreneurs, and innovators increasingly form robust bridges of cooperation. And ultimately, those human ties are the most enduring. They create empathy, understanding, and trust that no policy or treaty alone can guarantee. That is what gives this partnership its real strength.

• What does economic diplomacy mean for Kuwait today?

For Kuwait, economic diplomacy is not simply about financial returns; it is about advancing peace, stability, and shared prosperity. Kuwait has a long tradition of using its resources for development, whether through the Kuwait Fund for

Arab Economic Development or its global investments. Today, economic diplomacy means aligning investments with sustainability, climate goals, and human development. It’s about using financial tools to open doors for dialogue, to stabilize regions in conflict, and to anchor Kuwait as a trusted, long-term partner in the global economy.

• What message does Kuwait bring to international financial gatherings like the IMF and World Bank meetings?

Whether it is through its participation in the IMF and World Bank meetings this week, or in its larger positioning within

the global financial landscape, Kuwait personifies the fact that small nations can serve as anchors of stability. We bring a unique dual identity: as a resource-rich country but also as a humanitarian donor and development partner. Our message is that Kuwait’s story is one of responsibility, responsibility to manage our wealth prudently for future generations, to support countries in need, and to contribute to the global system in a constructive way. By doing so, we strengthen our position not just as an energy exporter, but as a responsible international stakeholder that prioritizes multilateral cooperation and value-based partnerships above all else.

• Why is Kuwait expanding its investments across different U.S. states, beyond traditional hubs?

This engagement reflects both strategy and, again, value-based participation. Strategically, it diversifies our economic partnerships within the United States, ensuring we are not confined to traditional financial hubs and modules. But more importantly, it reflects our belief that investment should serve people. By reaching underserved states, we create jobs, build infrastructure, and empower communities that are often overlooked. It’s a way of demonstrating that Kuwait’s friendship with the U.S. extends beyond Washington or New York, it reaches into the heartland. This builds goodwill and strengthens the long-term fabric of our bilateral relationship.

• How does the Embassy facilitate Kuwait’s economic engagement with the U.S.?

The Embassy plays a convening role, bringing Kuwait’s sovereign wealth fund, private investors, and financial institutions into conversation with U.S. policymakers and stakeholders. We ensure that Kuwait’s financial footprint is not only profitable but also strategic. For example, when Kuwait invests in infrastructure, renewable energy, or housing in the U.S., those choices reflect broader policy objectives of sustainability and partnership. The Embassy also serves as an advocate for Kuwait’s financial actors, ensuring their voice is heard in Washington and that their investments align with the values of transparency and trust.

• How would you describe Kuwait’s approach to diplomacy?

Kuwait has always practiced diplomacy with humility, humanity, and dialogue at its core. Unlike some actors who emphasize power projection, Kuwait emphasizes mediation, humanitarianism, and consensus-building. Our vibrant public debates reflect a political culture that values listening and inclusivity. These same qualities guide our foreign policy. This is why Kuwait has often been trusted as a mediator, whether in regional disputes or humanitarian crises. It is a diplomacy rooted not in hard power, but in moral authority, collective consciousness, and trust.

• Looking ahead, what role do you see Kuwait playing on the global stage?

I believe Kuwait’s future role will be defined by soft power, particularly in education, innovation, culture, creativity, and youth leadership. Kuwait has the potential to become a platform for dialogue between East and West, North and South. By investing in education, supporting cultural diplomacy, and empowering our youth, we will shape narratives that go beyond oil. The next decade is about reintroducing Kuwait to the world: not just as an energy provider, but as a hub of creativity, a source of humanitarian leadership, and a connector of cultures.

• What are the challenges and opportunities for Kuwait’s global image?

One of the challenges is ensuring that Kuwait is seen not only through the lens of energy or security, but also through innovation, entrepreneurship, and culture. At the same time, this is our opportunity to broaden the agenda. Whether it is humanitarian aid, climate adaptation, space cooperation, digital transformation, or healthcare, Kuwait has so much to offer. Personally, I am excited about expanding partnerships in education and innovation, areas where young Kuwaitis can directly connect with American peers and co-create solutions for the future.

• What advice would you give to young Kuwaitis aspiring to serve their country?

Representing your country is both a privilege and a responsibility. My advice to young Kuwaitis is: be authentic, be curious, and be courageous. To serve, you must be willing to listen deeply, to understand perspectives different from your own, and to carry Kuwait’s values with integrity. Equip yourself with knowledge, sharpen your communication, and never underestimate the power of humility. And remember that the most effective diplomats are not the loudest voices in the room. True strength in diplomacy lies in knowing when to speak, when to listen, and how to build trust through empathy and sincerity. The world respects authenticity and humility, and these are the values that will make you not just a representative of Kuwait, but an ambassador of its spirit.

• What do international partners value most about Kuwait?

International partners often tell me that what distinguishes Kuwait is our reliability, our transparency, and our sincerity. We honor our commitments, and we see relationships as long-term trusts, not short-term transactions. Partners also value our humanitarianism, the fact that Kuwait consistently steps forward in times of crisis, not for publicity, but out of principle. And finally, in a world often dominated by rhetoric, Kuwait brings authenticity, warmth, and genuine friendship to the table. It also doesn’t hurt that the leadership and people of Kuwait open their homes, hearts, and minds to all those they work with, and yes, they’ll tell you, we often serve the best food too! Those simple gestures of hospitality are not to be underestimated; they are what turn agreements into friendships, and partnerships into enduring bonds.

Sheikh Dr. Meshaal Jaber Al-Ahmad Al-Sabah KDIPA’s Strategy to Drive Diversification and High-Value FDI

How would you articulate KDIPA’s strategy for strengthening Kuwait’s investment climate and attracting foreign direct investment?

KDIPA’s strategy has been rooted in creating a globally competitive, investor-friendly environment conducive to attracting impact investment. This was made plausible through coordinating national efforts with competent government entities to streamline business measures adopting the best-in-class international practices, in alignment with the National Vision 2035 and its developmental objectives. We have resorted to an integrated strategic approach that encompasses streamlining regulatory frameworks. Our performance based incentives—such as 100% foreign ownership, tax and customs exemptions, as well as land allocation—target high-impact sectors including ICT, energy, healthcare, and financial services. With over USD 6.5 billion in FDI attracted across 16 sectors, KDIPA is driving job creation, technology transfer, local supply chain development, encouragement of national exports, and positioning Kuwait as a strategic gateway for high-value investments.

What are KDIPA’s key priorities in the near term to enhance Kuwait’s competitiveness as a global investment destination?

Our immediate priority is to accelerate Kuwait’s transformation into a global investment hub by attracting long-term, high-quality FDI that fosters innovation, sustainability, and national talent development. We are advancing strategic sectors—clean energy, smart infrastructure, and digital services—through PPPs and within the upcoming Economic Zone. Internationally, KDIPA is expanding its influence via bilateral and multilateral agreements, in addition to its Vice Presidency role at WAIPA, thus reinforcing Kuwait’s position as a resilient, forwardlooking investment destination anchored in smart cities and specialized zones.

What are some of KDIPA’s most significant advancements in recent years in securing highvalue investments?

Over the past decade, KDIPA has secured over USD 6.5 billion in FDI from 34 countries, targeting 16 strategic sectors. Beyond capital inflows, our impact is measured through job creation, national workforce training, technology transfer, and local content support. Our proprietary Kuwait Economic Benefit Model (KEBM) has tracked over USD 3.5 billion in local economic contribution. We have also launched targeted campaigns for sustainable investments in the Al-Abdali Economic Zone and earned global recognition through ISO certifications and leadership roles in WAIPA, reinforcing Kuwait’s emergence as a regional value-added direct investment hub anchored in innovation, sustainability, and strong international collaboration. Kuwait continues to be open for investment and KDIPA invites global partners to join us in shaping a future anchored in innovation, sustainability, and international collaboration—where strategic investments deliver impact.

How does KDIPA contribute to Kuwait’s broader efforts to diversify its economy and reduce dependence on oil revenues?

KDIPA plays a pivotal role in diversifying Kuwait’s economy by targeting investments into nonoil sectors such as technology, healthcare, renewable energy, entertainment, healthcare and education. Through our structured evaluation system, we prioritize projects with high potential for job creation, technology transfer, local content support, and export growth. Our economic zones in Al-Abdali, Al-Wafra, and Al-Na’ayem will host transformative PPPs that attract private and foreign capital, ensuring sustainable development and reducing reliance on oil revenues in sectors—such as technology, healthcare, renewable energy, infrastructure, education, and financial services.

How is KDIPA utilizing digital tools and platforms to simplify the investment process and position Kuwait as a cutting edge destination for global investors?

KDIPA is harnessing advanced digital platforms and real-time data analytics—to simplify the investment journey. Our digitized One-Stop-Shop enables investors to apply, track, and receive approvals efficiently, enhancing transparency and reducing delays. These tools also support global outreach campaigns, spotlighting Kuwait’s opportunities in techdriven and sustainable sectors. By integrating digital innovation, KDIPA is positioning Kuwait as a future-ready investment destination aligned with Vision 2035.

Chairman, Kuwait Airways Captain Abdulmohsen Salem Al-Fagaan: Kuwait Airways Soars Toward Global Excellence with Innovation, Sustainability, and Customer- Centric Vision

What is Kuwait Airways’ strategic vision for the next five years, particularly in light of global economic and environmental changes?

Kuwait Airways is steadily progressing towards the achievement of its strategic objectives. The company aspires to secure a prominent position among competing airlines by strengthening its fleet with the latest aircraft and enhancing its capabilities to reflect the stature as Kuwait’s national carrier. Kuwait Airways will continue to prioritize safety and customer service, while focusing on revenue growth and profitability. Furthermore, Kuwait Airways plans to expand its route network to achieve better results and ultimately, gain and retain customer trust, which is a top priority for the company.

How has Kuwait Airways evolved since its founding, and what key milestones have solidified its position as a regional player?

Kuwait Airways has maintained its reputation as a distinguished national carrier in the region by delivering exceptional and innovative services that cater to the requirements and expectations of its valued customers— from seamless booking across various channels to efficient travel procedures at Terminal 4, until boarding the aircraft, to enjoy a comfortable and seamless travel experience onboard.

Kuwait Airways operates one of the most modern fleet in the industry and offers state-of-the-art services. Backed by a team of highly skilled national professionals, Kuwait Airways prides itself on meeting the highest professional and technical standards required in commercial aviation. This combination of advanced capabilities and dedicated personnel has been instrumental in the company’s continued progress.

Operating from its exclusive Terminal 4, Kuwait Airways remains a competitive force in the aviation sector, a legacy that dates back to the 1950s and highlights the company’s rich heritage and enduring significance.

How does Kuwait Airways contribute to Kuwait vision 2035 and drive economic growth, particularly through initiatives that support trade, investment, and global connectivity?

It is well recognized that the GCC countries are collectively working toward positioning the Arabian Gulf region as a premier global tourism destination, and Kuwait is an integral part of this shared vision. Realizing this ambition requires the expansion of fleets and a strategic restructuring of aircraft utilization to

align with the evolving demands of the tourism and travel market.

Achieving this also depends on the availability of an airport infrastructure capable of handling increased flight operations and aircraft movements. Tourism fundamentally depends on two essential pillars: an airline operating a modern fleet of advanced aircraft, and an airport equipped with cutting-edge technologies and smart systems to ensure a seamless travel experience.

What have been the most significant challenges for Kuwait Airways such as the pandemic or fuel price fluctuations, and how were they addressed to ensure resilience?

Challenges such as the COVID- 19 pandemic, fuel price fluctuations, and geopolitical conditions are inevitable in the aviation industry. Kuwait Airways remains well-prepared through swift and effective contingency plans that ensure the continuity of operations. The safety of passengers and aircraft remains the company’s highest priority, supported by strategies aimed at mitigating losses from unforeseen events, which include identifying alternative revenue sources and enhancing business growth.

How does Kuwait Airways balance profitability with its role as a national carrier, especially amid global economic pressures?

Kuwait Airways’ Board of Directors has established a comprehensive and well-considered plan to enhance the company’s performance in the coming period. This plan includes prioritizing customer satisfaction by offering comfort and meeting the passenger requirements, enhancing operational systems, and developing national talent.

The Board has also merged departments in a way that supports workflow efficiency and enhances productivity. In addition, it has initiated a process of workforce renewal and succession planning, which has contributed to reducing expenses, encouraging young national talent, and preparing them for leadership roles – thereby actively contributing to the improvement and development of overall performance.

We are optimistic about the upcoming phase, supported by the political leadership, and by the Kuwait Investment Authority under the guidance of its Managing Director, His Excellency Sheikh Saoud Salem Al-Sabah.

In the highly competitive regional aviation market, how is Kuwait Airways differentiating its brand and strengthening its position?

We have adopted a strategy that strongly focuses on keeping pace with the latest developments in the commercial aviation sector, whether in terms of technology, operations, or investing in human capital and training employees. This approach aligns with the level of responsibility we bear in striving to achieve the highest level of quality.

This is for several reasons, with the primary focus being on the service aspect for our valued passengers, ensuring smooth travel procedures, maintaining punctual flight departures and arrivals, responding to customer preferences by launching new destinations and introducing a variety of services that distinguish Kuwait Airways from other carriers.

On the operational side, we are committed to utilizing the latest modern technologies across the entire system, in addition to gradually implementing digital transformation across various departments within the company.

We are moving forward according to carefully developed plans established by the Board of Directors and executed by the Executive Management. Kuwait Airways has been experiencing continuous growth over the past two years, as reflected in our publicly announced quarterly results, which demonstrate unprecedented level of positivity.

These outcomes affirm the success of key improvements, such as relocating to Terminal 4 and enhancing passenger services both on the ground and onboard, and have had a clear positive impact. These recent achievements motivate Kuwait Airways to continue expanding and innovating as part of our next development phase, always guided by our company’s guiding principle: “Customer First.”

How is Kuwait Airways leveraging advanced digital technologies, such as AI and data analytics to enhance its services?

Technology today plays a vital role in enhancing the company’s services for passengers by making processes faster and more efficient, and this is exactly what Kuwait Airways is doing by continuously improving and upgrading its website and mobile application and has launched a range of services through these platforms to better meet the needs of its passengers.

In addition, technology is also being integrated into operational systems and equipment to facilitate the work of engineers and pilots within the operational framework.

Kuwait Airways is making substantial investments in this area, recognizing that technological advancement, particularly in the aviation sector, is essential for delivering innovative solutions. These tools empower employees to provide superior service, fully aligned with the highest international standards.

How does Kuwait Airways support Kuwait’s national tourism strategy, and what initiatives promote Kuwait as a tourism destination?

By actively participating in a wide range of activities, events, and initiatives such as those organized by the State, for example, the participation in the events of the Ministry of Information it launches, accordingly, Kuwait Airways supports the development and promotion of tourism and highlights the State of Kuwait regionally and globally as the national carrier of the country and as an integral part in the country’s development journey.

In addition, Kuwait Airways has signed numerous agreements and partnerships with national companies and government entities, such as with Zain, the Public Authority for Applied Education and Training, the Touristic Enterprises Company, Kuwait Oil Company, Kuwait Flour Mills Company, and others.

What are Kuwait Airways’ plans to expand its global presence, particularly through strategic partnerships or targeting emerging markets?

Kuwait Airways has established numerous partnerships with leading airlines and other agreements related to the aviation sector, reflecting its commitment to fostering mutual cooperation and strengthening global relationships with companies around the world, such as Turkish Airlines, Saudia, Thai Airways, and others through codeshare agreements.

Additionally, passengers benefit from integrated travel options through partnerships with major railway operators, including Deutsche Bahn (Germany) and Saudi Arabia Railways (SAR), further enhancing travel connectivity and convenience for customer and to ensure a seamless travel experience.

What steps is Kuwait Airways taking to enhance customer experience, whether through onboard services or loyalty programs?

Kuwait Airways has achieved many accomplishments, the most notable of which is the development and enhancement of the travel experience on board flights in terms of luxury, entertainment programs, and comfort, achieving high

percentages in passenger and aircraft traffic at Terminal T4, and reaching the highest levels of quality in customer service.

Moreover, Kuwait Airways has revised and reduced ticket prices to make them more accessible to everyone and competitive within the aviation market. Kuwait Airways also regularly launches special offers and discounts for travel on Kuwait Airways, promoting them across all shopping malls and various advertising platforms.

Furthermore, by maintaining an advanced level of punctuality of departure and arrival timings during the summer season.

This is in addition to Kuwait Airways achieving the 20th position globally and 5th position in the Arab world according to the ranking of the best-performing airlines worldwide, published by ‘AirHelp’ for the year 2024.

Kuwait Airways is now striving to enhance and develop a modern, advanced fleet in the coming years. The current Board of Directors, with strong support from the political leadership, has managed to achieve many accomplishments and successes.

What measures is Kuwait Airways implementing to align with global sustainability goals, such as reducing carbon emissions or adopting eco-friendly technologies?

Kuwait Airways’ new Airbus fleet is designed with a strong focus on environmental sustainability, incorporating advanced technology to significantly reduce carbon emissions. These aircraft are classified as environmentally friendly and reflect the airline’s commitment to operating responsibly.

Kuwait Airways consistently aligns with the latest international aviation standards, actively supporting global efforts to minimize carbon emissions and adopt sustainable, eco-conscious technologies across its operations.

With an Increase of 4.3% KD 882.2 Million Net Profits of Kuwaiti Banks in H1 2025

The nine Kuwaiti banks recorded a 4.3% increase in their net profits during the first half of 2025, amounting to KD 36.4 million, rising from approximately KD 845.8 million in the first half of 2024 to about KD 882.2 million. Figures indicate that 6 banks achieved profit growth, while 3 banks reported a decline in profits compared to the same period last year.

4.3% Increase in Conventional Banks’ Profits

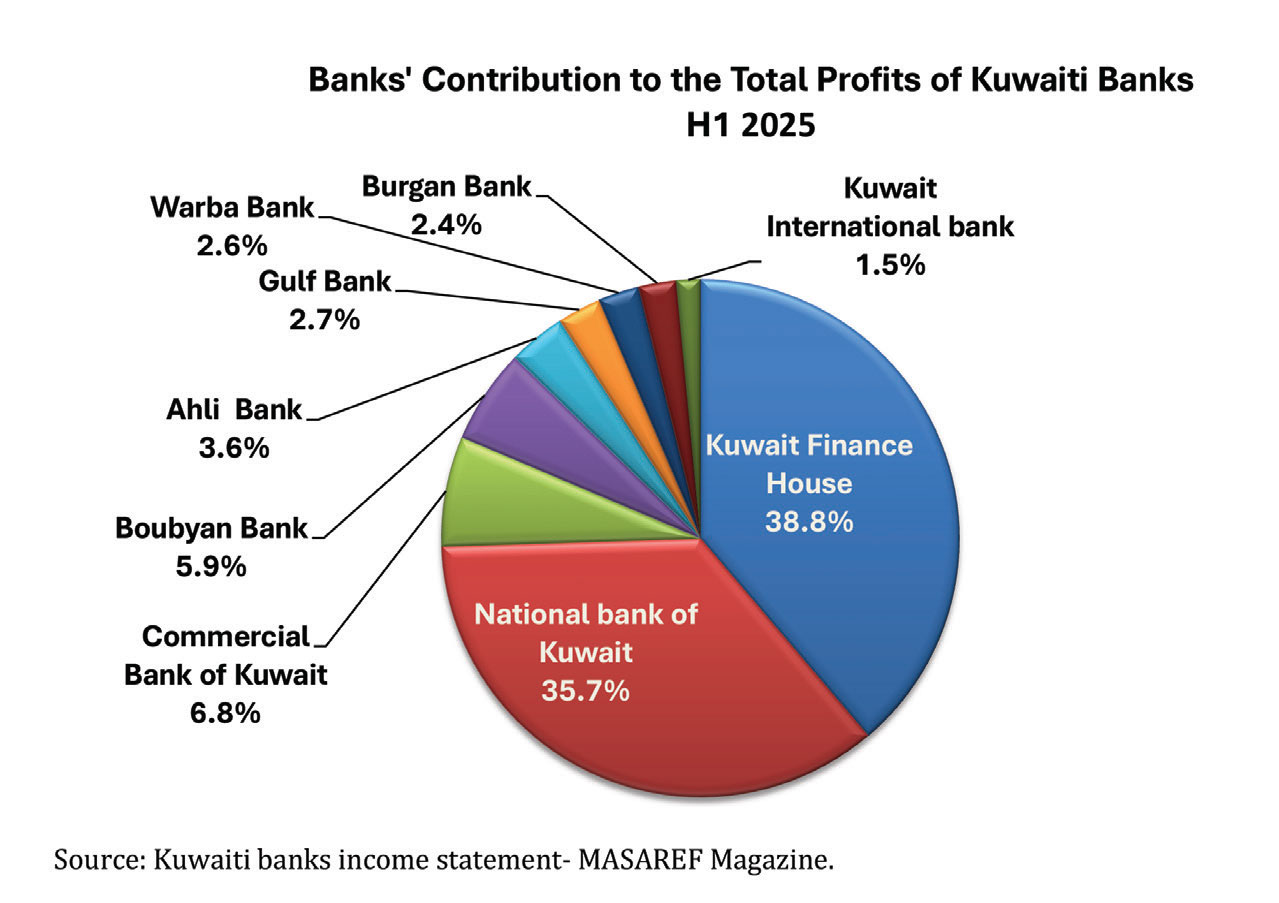

The first half of 2025 witnessed better performance among the conventional banks group compared to the first half of 2024, with a 4.3% increase in net profits, rising by KD 18.6 million to reach KD 452.2 million compared to KD 433.6 million in the first half of 2024. This improvement is mainly due to the remarkable increase achieved by the National Bank of Kuwait. The contribution of conventional banks to the total profits of Kuwaiti banks was approximately 51.3% in the first half of 2025 (with the National Bank’s profits constituting 35.7% of the total profits of all banks).

4.3% Increase in Profits of Islamic Banks

In the first half of 2025, the Islamic Banks Group maintained its share of Kuwaiti banks’ total profits at approximately 48.7% (with KFH’s profits constituting 38.8% of the total profits of all banks). The group’s net profit increased by about KD 17.8 million and by 4.3%, reaching KD 430.0 million compared to KD 412.2 million in the first half of 2024. This was mainly due to Warba Bank’s increase (which accounted for 74% of the total increase achieved by the Islamic Banks Group).

KFH and NBK Together Accounted for 74.5% of the Sector’s Total Net Profit

KFH’s profits made up 38.8% of the total profits of all banks in the first half of 2025, compared to 40.3% during the corresponding half last year. NBK’s profits represented 35.7% of the total profits of all banks in the first half of 2025, compared to 34.6% during the corresponding period last year. The Commercial Bank of Kuwait came in third place with 6.8%, followed by Boubyan Bank with 5.9%, Al Ahli Bank with 3.6%, Gulf Bank with 2.7%, Warba Bank with 2.6%, Burgan Bank with 2.4%, and Kuwait International Bank with 1.5%.

KFH Records Highest Profits Among Kuwaiti Banks

Kuwait Finance House (KFH): Achieving the highest net profit among banks, it recorded approximately KD 342.2 million during the first half of 2025 compared to KD 341.2 million in the first half of 2024, with a growth of KD 0.9 million or by 0.3%.

National Bank of Kuwait (NBK):

Reaching KD 315.3 million net profit during the first half of 2025 (topping the list of conventional banks) compared to KD 292.4 million in the first half of 2024, with a growth of KD 22.8 million or by 7.8%.

Commercial Bank of Kuwait:

Recording KD 60.4 million net profit, with a decrease of KD 2.3 million or by -3.7%, compared to approximately KD 62.7 million in the first half of 2024.

Boubyan Bank:

Achieving approximately KD 52.3 million net profit during the first half of 2025, with a growth of KD 2.7 million or by 5.4% compared to KD 49.6 million in the first half of 2024.

Al Ahli Bank of Kuwait:

Recording KD 31.7 million net profit during the first half of 2025, with a growth of KD 2.7 million or by 9.3% compared to KD 29.0 million in the first half of 2024.

Gulf Bank:

Reaching KD 24.0 million net profit during the first half of 2025, with a decrease of KD 4.2 million or by -14.9% compared to KD 28.2 million in the first half of 2024.

Warba Bank:

Recording KD 22.5 million net profit during the first half of 2025, with an increase of KD 13.2 million or by 141.3% compared to KD 9.3 million in the first half of 2024.

Burgan Bank:

Recording KD 20.8 million net profit during the first half of 2025, with a decrease of KD 0.4 million or by -1.9% compared to approximately KD 21.2 million in the first half of 2024.

Kuwait International Bank:

Reaching KD 13.1 million net profit during the first half of 2025, with a growth of KD 1.0 million or by 8.7% compared to KD 12.0 million in the first half of 2024.

Reflecting a Year-on-Year Growth of 7.8% NBK Reports KD 315.3 Million in Net Profit for 1H2025

National Bank of Kuwait (NBK) has announced its financial results for the six-month period ended 30 June 2025, reporting a net profit of KD 315.3 million (USD 1.0 billion), compared to KD 292.4 million (USD 957.8 million) for the corresponding period in 2024, marking a year-on-year increase of 7.8%. Profit before tax reached KD 401.5 million (USD 1.3 billion) during the period, marking a 17.0% increase compared to KD 343.1 million (USD 1.1 billion) in the corresponding period of 2024.

As of the end of June 2025, total assets rose by 15.9% year-on-year to KD 43.6 billion (USD 143.0 billion), while total loans and advances grew by 12.1% year-on-year, reaching KD25.5 billion (USD 83.5 billion).

Customer deposits grew by 9.5% on an annual basis, reaching KD 23.9 billion (USD 78.2 billion) by the end of June 2025. Meanwhile, shareholders’ equity reached KD 4.2 billion (USD 13.9 billion), reflecting a growth of 10.3% year-on-year.

The Board of Directors has opted to retain interim earnings till year-end, focusing on end of year final dividend distribution. The decision reflects the Board’s commitment to strengthening the Group’s balance sheet in seizing promising growth opportunities across its operating markets, particularly in light of the anticipated pickup in business activity in Kuwait, while maintaining flexibility in managing interim capital adequacy ratio.

A Robust Strategy

Commenting on the Bank’s 1H2025 financial results, Mr. Hamad Al- Bahar, NBK Group Chairman stated, “NBK’s strong performance reflects its ability to navigate varying economic conditions, even amid heightened geopolitical challenges and global trade tensions stemming from recent U.S. tariffs. The Bank’s solid operational results underscore the strength of its well-established strategy, anchored in a diversified business model and prudent risk management.”

Al-Bahar emphasized that NBK’s strong balance sheet, solid capital base, and high asset quality reinforces the Bank’s ability to deliver sustainable profitability and optimal returns for shareholders and customers, while continuing to support the prosperity of the communities in which it operates.

Al-Bahar noted that the Bank achieved several milestones across various areas during the first half of the year, most notably its selection as Kuwait’s Main Settlement Bank. He emphasized that this recognition reflects years of continuous investment in enhancing the Bank’s digital infrastructure, which qualified NBK to meet the technical and operational requirements set by Kuwait Clearing Company (KCC); securing the highest ratings among participants in the Central Counterparty Project (CCP).

Reflecting its long-standing commitment to sustainability, Al- Bahar noted that NBK has continued to make significant strides toward a more sustainable future. He pointed to recent upgrades in the Bank’s ESG ratings by leading global agencies, including Morningstar Sustainalytics and MSCI, as clear recognition of NBK’s dedication to environmental stewardship, social responsibility, and sound governance practices. This was reinforced by the publication of the first allocation and impact report for its debut USD 500 green bond issued in

June 2024, which is the first issuance of its kind in Kuwait. The report provides relevant information that highlights the allocation of proceeds from the green bond as of 31 March 2025 and the estimated environmental impact during the reporting period.

Sustainable Growth

Meanwhile, Mr. Isam J. Al-Sager, NBK Group Vice Chairman and CEO, said: “Once again, NBK continues to affirm the resilience of its business model and its agility in navigating a shifting operating environment, consistently delivering profit growth across economic cycles. This performance underscores the strength of the Group’s geographic diversification

strategy and the effectiveness of its long-term approach to driving sustainable growth.”

He noted that the Bank delivered solid operating performance across its core business segments during the first half of 2025, with the Group’s net operating income rising by 3.1% year-on-year to reach KD 631.4 million (USD 2.1 billion).

Al-Sager highlighted the strong contribution of the International Banking Group (IBG), as well as Boubyan Bank — the Islamic banking arm of NBK— to the Group’s net operating income and profitability during 1H2025. In addition, NBK Wealth continues to strengthen its position as the leading wealth management firm in Kuwait and among the largest in the region; offering a comprehensive suite of private banking, wealth and investment management solutions and advisory services through an integrated global network.

During the first half of 2025, NBK continued to deliver an enriched banking experience, underpinned by innovative solutions tailored to meet evolving customer needs. The Bank further reinforced its digital leadership by introducing a suite of carefully designed digital services and products aligned with customer expectations.

He added that NBK remains committed to investing in technology and innovation as a core driver of growth, underscoring the Bank’s focus on strengthening its competitive edge in the domestic market and expanding its presence across international markets.

Regarding NBK’s recent USD 800 million PNC6 Additional Tier 1 bond issuance, Al-Sager emphasized that strong investor demand afforded the Bank a notable pricing advantage. He noted that the order book peaked at USD 2.2 billion, with subscriptions exceeding 2.75x the issue size; driven by solid interest from a diverse base of global investors and financial institutions.

The Operational Environment

Commenting on the local operating environment, Al-Sager expressed cautious optimism regarding the outlook for project activity in the second half of the year and beyond. He pointed to the government’s announcement of 141 projects under the 2025/2026 annual development plan, including large-scale ventures such as Mubarak Al-Kabeer Seaport, the expansion of the T2 passenger terminal at Kuwait International Airport, and the New Al-Sabah Hospital, as key drivers of anticipated momentum.

Furthermore, he emphasized that the adoption of further economic legislative reforms would serve as a catalyst for accelerated economic growth, commending the government’s commitment to enacting key legislation in the near term, including the anticipated approval of the mortgage law. He also underscored the importance of empowering the private sector to take a leading role in economic activity under Kuwait Vision 2035, noting that such measures are vital to enhancing the local business climate and supporting the growth of the national economy going forward.

Prestigious Awards

During the first half of 2025, NBK garnered several prestigious accolades that reaffirm its leadership both locally and regionally. These included being named Best Bank in Kuwait – 2025, as well as receiving awards for Best Retail Bank and Best Bank for SMEs in Kuwait by MEED International Magazine.

Euromoney magazine also honored the Bank with multiple accolades in 2025, naming NBK Kuwait’s Best Bank for ESG, Kuwait’s Best Bank for Large Corporates, and Kuwait’s Best Bank for Diversity and Inclusion.

Moreover, NBK has also garnered multiple accolades across the MENA region, including Best Loan Offering-2025, Best Contactless Payment Experience, and Payment Solution for SMEs, awarded by MEED Magazine.

Al-Tijari Declares Net Profit of KD 60.4 Million for the 1st half 2025

Interim Cash Dividend 12 fils per Share

Commercial Bank of Kuwait announced a net profit of KD 60.4 million for the half year ended end 30 June 2025 compared to KD 62.7 million for the same period last year. Earnings per share for the current period is 30.6 fils (June 2024: 31.8 fils).

Operational Performance:

Sheikh Ahmad Duaij Al Sabah, the Bank’s Chairman, presented the Bank’s results for the first half of 2025 with a Net Profit of KD 60.4 million, reflecting a year-on-year decline of KD 2.3 million (3.7%) due to lower net recovery against previously written off loans . Operational profit before provisions reflects a stable year-on-year performance amidst the prevailing economic uncertainties and lower interest rates. The operational performance was aided by 1.9% growth in loans and 3.7% increase in fee income, partly offset by lower foreign exchange income. Loans and advances grew by KD 51.5 million compared to HY 2024.

Regulatory Ratios:

Regulatory ratios remained strong and continue to be well above the Central Bank’s statutory requirements. Capital Adequacy Ratio is at 18.0%, Liquidity Coverage Ratio 232.6%, Net Stable Funding Ratio 104.5% and Leverage ratio 10.6%.

Performance Ratios:

Sheikh Ahmad emphasised that Al-Tijari continues to report stable performance ratios considering the global economic challenges. Net interest margin for HY 2025 at 2.64%, Return on Equity 16.4% and Return on Assets 2.8% reflect the efficient management and strong operational performance. Cost to income ratio 34.1% remains to be one of the lowest amongst Kuwaiti banks.

Business updates:

Sheikh Ahmad added that Al-Tijari continues to make swift strides in its digitalization journey, enhancing its digital platforms and launching innovative customer services. These advancements reflect the Bank’s commitment to provide seamless and user-friendly banking experiences.

The notable business engagements during the first half of 2025 are:

- The Bank offered sponsorship and participation in Kuwait New Strategic Economic Conference 2025 organized by Kuwait Direct Investment Promotion Authority. The conference aims to support national economic diversity, promote investment in strategic sectors and empower financial markets.

- The Bank expanded its self-service network by installing new machines at several strategic locations across Kuwait. Thisinitiative aligns with Bank’s commitment to enhance customer experience by providing easy access to essential banking services close to their homes.

- Facility to withdraw various foreign currencies from the Smart teller machine was introduced at the Airport branch and some other branches.

Diligent Efforts for Raising Customer Awareness:

In an effort to connect with a wider audience and promote its offerings, Al-Tijari organized outreach events at various office and commercial complexes. These events served as a platform to introduce customers to the Bank’s range of products and services, educating customers that maintaining the confidentiality of their banking and financial information is of paramount significance, while also fostering greater financial literacy among diverse segments of society.

Additionally, the Bank actively leveraged its electronic channels to raise awareness about cybersecurity. Through targeted communication messages and diverse activities, it educated customers on the importance of safeguarding their banking information and staying vigilant against potential fraud as part of the flagship campaign “Let’s Be Aware”. That Campaign aims to promote financial awareness across a wider segment of society and enhance awareness regarding the role of the banking sector and means to benefit the most from the services provided by banks. The Campaign educates customers on the different types of fraud and electronic crimes and scams, which target customers via email, SMS messages, smart phone applications, phone calls or other applications.

Sustainability and Social Responsibility:

The key initiatives taken during the period were:

- In collaboration with a leading international risk management consultancy firm, the Bank successfully concluded the “Future of Sustainability: ESG Insights” seminar. The focus was on the importance of ESG sustainability principles within the business strategy of companies and their role in sustainable transformation and long term value enhancement of the companies.

- The Bank organized a beach cleanup campaign in Sharq area, in partnership with Kuwait Dive Team and Al-Tijari volunteer team. The aim was to remove waste from shorelines to reduce marine pollution. The campaign reflects Bank’s ongoing commitment to environment preservation and sustainable practices, while encouraging active public participation in environmental protection.

- Al-Tijari continues to show a strong commitment to society by providing comprehensive support and care for social events organized by civil society institutions. These events and initiatives collectively aim to serve all segments of the society and underscore the Bank’s distinct footprint in the field of social responsibility.

Thank You Note

Sheikh Ahmad concluded by extending his sincere gratitude and appreciation to all the regulatory authorities, especially the Central Bank of Kuwait for their continuous support to the banking industry and to Bank’s shareholders, management, employees and customers for choosing Al-Tijari as their banking services provider hoping that Al-Tijari will remain as always “Customers’ Bank of Choice”.

For the first half of 2025: Gulf Bank records KD 24 million in Net Profit and Operating Income of KD 91.8 million

Gulf Bank announced its financial results for the first half ending 30 June 2025. The Bank reported a net profit of KD 24.0

million, a decline of KD 4.2 million or 14.8% compared to 2024 first half net profit of KD 28.2 million.

In addition, Gulf Bank recorded an operating income of KD 91.8 million for the first half of 2025, representing a decline of 5.3% compared to the same period of last year. Moreover, operating profit before provisions and impairments was KD 44.9 million, representing a decline of 14.7% compared to the first half of 2024.

As for the second quarter ending 30 June 2025, Gulf Bank reported a net profit of KD 14.7 million and an operating income of KD 47.8 million, both representing a slight decline of 4.3% and 1.7% respectively, when compared to the same period of the prior year. However, when compared to the first quarter of 2025, net income has increased from a reported KD 9.4 million in the first quarter to KD 14.7 million for the second quarter, a significant improvement of KD 5.3 million or 57.0%. Similarly, operating income increased by KD 3.8 million or 8.7% in the second quarter when compared to the first quarter of 2025.

Financial Performance

The decline in net profit for the first half of 2025 is attributed to the decline in net interest income of KD 4.9 million or 6.3%, coupled with an increase in operating expenses of KD 2.6 million or 5.8%, compared to the same period of 2024. However, these declines were partially offset by an improvement in total provisions, which declined by KD 3.4 million or 14.7% year-on-year, reaching KD 19.6 million in the first half of 2025.

As for asset quality, the non-performing loans (NPL) ratio was 1.4% as of 30 June 2025, compared to the prior year level of 1.2%. Additionally, the Bank continues to have significant non-performing loans coverage ratio of 317% including total provisions and collaterals.

Total credit provisions as of 30 June 2025 reached KD 275 million whereas IFRS 9 accounting requirements (i.e., ECL or expected credit losses) were KD 180 million. As a result, the Bank has a healthy excess provision level of KD 96 million, above and beyond what is required by the IFRS 9 accounting requirements.

Compared to 31 December 2024, total assets declined by 2.4% to KD 7.3 billion, whereas net loans and advances increased by 3.8% to KD 5.7 billion. On the other hand, total deposits stood at KD 5.4 billion and total Shareholders’ equity reached KD 825 million.

The Bank’s regulatory Tier 1 ratio of 14.6% was 2.6% above the regulatory minimum of 12% and the Capital Adequacy Ratio (CAR) of 16.8% was 2.8% above the regulatory minimum of 14%.

Strategic Clarity

Commenting on the financial results for the first half of 2025, Gulf Bank Chairman Mr. Ahmad Mohammad Al-Bahar stated: “Gulf Bank’s performance during the first half of 2025 demonstrates resilience and clarity in the face of a complex operating environment. Rising geopolitical tensions and oil price fluctuations have added volatility to regional markets and shifted fiscal priorities. Despite these headwinds, Gulf Bank has maintained its solid fundamentals and strategic direction, enabling us to remain adaptive and forward-looking.

He continued: “One of the most significant initiatives under consideration is the potential conversion of Gulf Bank into a fully Sharia-compliant institution. This transformation aligns with our long-term vision and would allow us to expand our reach, diversify our offerings, and better serve the evolving needs of our clients. Moreover, we have signed a Memorandum of Understanding with Warba Bank stating the basis of cooperation in

assessing the proposed merger between both banks independently ensuring the best interest of all the Bank’s shareholders in line with regulatory controls.”

Mr. Al-Bahar concluded: “We look ahead to the second half of the year with confidence in our strategic direction and the strength of our team. On behalf of the Board of Directors, I extend my appreciation to our shareholders, employees, and customers for their continued trust and support. We also thank the Central Bank of Kuwait and regulatory authorities for their guidance. Gulf Bank remains committed to delivering high-quality banking services and supporting Kuwait’s financial future.”

Operational Discipline

Gulf Bank Acting Chief Executive Officer, Mr. Waleed Khaled Mandani, stated: “Despite persistent pressure on margins across the sector, our second quarter results reflect strong execution and a prudent approach to managing our operations. We continued to maintain a balanced approach between credit expansion and asset quality, ensuring the resilience and integrity of our loan book. Our low non-performing loan ratio and high coverage levels underscore the effectiveness of our risk management framework and our ongoing commitment to financial stability.”

He added: “We are also advancing our internal readiness for a potential Islamic Sharia-compliant conversion subject to being granted with the necessary regulatory and shareholders’ approvals. The essential systems, governance frameworks, and talent are being explored for a smooth transition. At the same time, we continue to deliver practical banking solutions and maintain the agility needed to respond effectively to changing market conditions.”

Mr. Mandani further noted: “Recent government debt issuances, estimated at KD 600 million locally and another potential USD 6 billion internationally are expected to support government spending on capital development projects across vital sectors including infrastructure, housing, and logistics, thus accelerating economic activity and enabling faster participation by banks in financing national initiatives. Moreover, such instruments could provide banks with added flexibility in managing their balance sheets and capturing emerging financing opportunities. We remain opportunistic in utilizing these tools to support our growth plans.”

Credit Ratings and Recognitions

Gulf Bank’s financial strength and operational resilience were affirmed by leading credit rating agencies. Fitch Ratings assigned a Long-Term Issuer Default Rating (IDR) of ‘A’ with a Stable Outlook, while Moody’s rated long-term deposits at ‘A3’ with a Positive Outlook. Capital Intelligence affirmed a Long-Term Foreign Currency rating of ‘A+’ with a Stable Outlook, further highlighting the Bank’s stability and sound risk management practices.

Reinforcing its position as a digital leader in the region, Gulf Bank has been awarded the “Best Mobile Banking Application and Experience” by MEED business intelligence platform during the Middle East and North Africa Banking Excellence Awards ceremony. This prestigious recognition highlights Gulf Bank’s ongoing commitment to delivering an advanced, exceptional digital banking experience to meet customer expectations and enhance ease of access to banking services.

Responsible Banking

During the second quarter of 2025, Gulf Bank advanced its ESG agenda through impactful environmental and social initiatives aligned with its 2030 Sustainability Strategy. A key milestone during the quarter was the official launch of the Bank’s Sustainable Finance Framework and internal Sustainability Risk Management Policy, aimed at integrating ESG considerations into lending decisions, operations, and risk oversight. In parallel, the Bank remained active across various community initiatives, with an emphasis on youth development, financial literacy, and education. These programs reflect Gulf Bank’s ongoing commitment to supporting inclusive growth, empowering the next generation, and contributing to Kuwait’s broader sustainable development goals.

Al Ahli Bank of Kuwait Announces H1 2025 Financial Results: 9% Increase in Net Profit to KD 31.73 Million

Al Ahli Bank of Kuwait (ABK) proudly announced its robust financial results for H1 2025, once again affirming its position as a leading financial institution.

Financial Performance

ABK Group recorded a net profit attribute to shareholders of KD 31.73 million, up 9% year-on-year. Earnings per share stood at 11 fils, and operating profit increased by 18% to KD 62.94 million.

Operating income increased year-on-year by 8% to KD 108.83 million. Total assets grew year-on-year by 8% to KD 7.19 billion, loans and advances grew by 5% to KD 4.72 billion, while customer deposits rose 9% to KD 4.32 billion, affirming the Group’s reputation as a trusted financial partner.

The non-performing loan (NPL) ratio stood at 1.35%, covered by provisions at 447%. The Capital Adequacy Ratio (CAR) was 16.96%, and shareholders’ equity rose by 4.6% to KD 635.38 million, further underscoring ABK’s financial stability.

On this occasion, Mr. Talal Mohammad Reza Behbehani, Chairman of ABK, stated that the Group’s results for the first half of 2025 reflect the strength of its financial position and its success in achieving strategic objectives. He emphasized, “These achievements were made possible through the implementation of diverse plans aimed at developing ABK’s banking services and products, clearly demonstrating the Group’s ability to maximize returns for shareholders.”

Behbehani added that ABK’s profits were achieved as part of the ongoing development of the Bank’s strategy to keep pace with advancements in the banking industry locally, regionally, and globally. He explained that the Group’s prudent approach in mitigating global economic challenges contributed to continued growth across of its key financial indicators during the first six months of 2025.

He stressed that digital transformation remains a core pillar of ABK Group’s operations, with a focus on integrating advanced digital technologies across the organization to ensure seamless customer experience across our different lines of business. The Bank is also committed to harnessing artificial intelligence in its operations to elevate the quality of banking services and diverse solutions provided to all customer segments.

Behbehani further emphasized that ABK Group dedicates all its resources to supporting the successful realization of the New Kuwait 2035 vision and is committed to working alongside relevant stakeholders to facilitate the financing and development of upcoming national projects.

Awards, Ratings and ESG

Behbehani revealed that the Group has continued to earn the confidence of global institutions, as evidenced by several awards received since the beginning of the year. These include the ‘Best Digital Transformation Initiative’ award at the 2025 MEED Middle East Banking Excellence Awards, as well as the ‘Best Call Center’ in the banking sector in Kuwait award from Global Brands Magazine. He noted that these awards came as a result of recent enhancements to ABK’s customer service center, the launch of an entirely new mobile application and the ongoing development of the Bank’s website to provide world class round-the-clock customer service.

He also highlighted that ABK has successfully maintained its strong credit ratings of ‘A’ from Fitch and ‘A2’ from Moody’s, which underscores the Group’s solid financial position and its ability to navigate challenges while meeting the expectations of financial rating agencies evaluating the performance of Kuwait’s banking sector.

Behbehani pointed out that ABK Group is committed to applying sustainability standards across all of

its daily operations and in all markets where it operates. He emphasized the Bank’s recent recognition as a leading institution in environmental sustainability through its ranking in Kuwait’s first-ever Climate Sustainability Index. He confirmed that the Group will continue to publish comprehensive annual sustainability reports to provide transparent updates on developments across all aspects of its operations.

In conclusion, Behbehani expressed his gratitude to the Board of Directors, executive management and all ABK employees for their ongoing efforts and contributions to the success of the Group’s plans and its growing position as a leader in the banking sector. He also acknowledged the continuous support ABK receives from all regulatory authorities in Kuwait, Egypt and the UAE, whose collaboration helps foster growth and advancement across the banking sector.

Future Plans

In turn, Mr. Abdulla Al Sumait, Deputy Group CEO of ABK, affirmed, “The Group’s profits for the first half of 2025 are the result of close collaboration between various divisions and teams to successfully execute the Group’s strategic plans. They reflect ABK’s ability to improve its profitability and capital strength indicators and effectively respond to evolving market dynamics.”

Customer Engagement

The first half of 2025 also witnessed increased engagement between ABK and its customers, with the Bank organizing several exclusive events, including a private forum for Private Banking clients and ABK Capital, the Group’s investment arm, to update them on the latest developments in the banking and investment sectors.

In addition, during the first six months of 2025, the Bank signed multiple partnership agreements to provide exclusive offers for its customers, including renewing its partnership with Emirates Skywards and introducing discounts for ABK cardholders. These initiatives reinforce the Bank’s reputation as the preferred banking partner for customers.

Regional Expansion

In addition, ABK Group continued to expand its operations internationally by opening new branches in Egypt, launching additional products to grow its customer base in the UAE, and establishing a subsidiary of ABK Capital in the Dubai International Financial Centre. These steps will enhance the integration of the Group’s operations.

Community Initiatives